seattle payroll tax ordinance

While the ordinance has not yet been signed by the mayor as of publication the tax. To administer and evaluate the effectiveness of the payroll tax authorized by the ordinance introduced as Council Bill 119810 to administer the investments described in subsections 2B2 through 2B5 of this ordinance and to evaluate.

Sorry Amazon And Microsoft Workers No More Special Rental Deals For You In Seattle Geekwire

Adding a new chapter 5.

. The spending plan may be amended from time to 10 time by the City Council by ordinance. Imposing a payroll expense tax on persons engaging in business in seattle. WHEREAS the City will enact an employee hours tax to be followed and replaced by a business payroll tax but because of uncertainty in the timeline due.

The move which went into effect Jan. Compensation includes all payments for personal services. Payroll expense tax Beginning Jan.

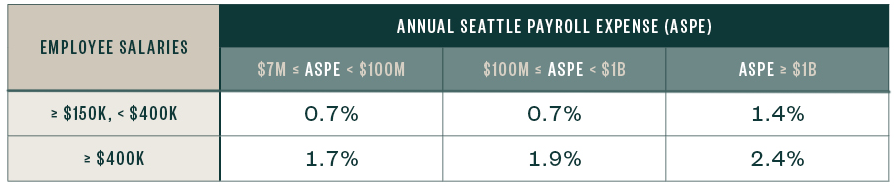

A smaller employer with a total payroll of less than 7 million is not subject to tax. 1 2021 the Seattle payroll expense tax is imposed using a three-tier structure determined by annual business revenue and level of employee compensation. AN ORDINANCE related to creating a fund for Payroll Expense Tax revenues.

The ordinance takes effect at the start of 2021 and sunsets at the end of 2040. Adding a new Section 538055 to the Seattle Municipal Code. A business must have at least 7 million in Seattle payroll in the prior calendar year to be subject to the tax.

While the ordinance has not yet been signed by the mayor as of publication the tax was passed by the council on July 6 2020 by a veto-proof majority 7-2 and is expected to become law effective. Seattle City Council Bills and Ordinances Information modified on May 18 2021. The payroll expense tax is a tax on employers that have Seattle annual payroll expense of 7 million or more.

Ordinance 126108 and the Seattle Municipal Code SMC 538070 specify annual adjustments to the payroll expense dollar thresholds and exemption thresholds for the Payroll Expense Tax. The applicable tax rate depends on the total amount of the employers Seattle payroll and the taxable compensation of its employees earning more than 150000 per year. The City of Seattle has finalized their rule on the new payroll expense tax which became effective January 1 2021.

An ordinance relating to taxation. Employers subject to the tax include for-profit businesses and not-for-profit organizations The starting tax rate is 07 on compensation paid to Seattle employees greater than 150000. This item was originally posted in our Legislative Information Center.

Seattle has finalized its payroll expense tax rules effective January 1 2021. Implementation and administrative costs. An ordinance was passed on May 16 2018 that would have imposed the Employee Hours Tax a head tax on Seattle businesses with 20 million or more in taxable gross income.

The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle. The payroll expense tax is levied upon businesses not individual employees. 1 2022 and on January 1 of every year thereafter the dollar thresholds will increase based on the rate of growth of the prior years June-to-June Consumer Price Index.

Employers cannot deduct the amount of tax from their employee compensation. CB 119250 signed Ordinance 125578 was a scaled-down version of the previously proposed employer payroll tax that would have imposed a yearly surcharge of 500 per employee. The payroll expense tax.

WHEREAS on July 6 2020 the City Council Council adopted the ordinance introduced as Council Bill CB 119810 authorizing the collection of a new payroll expense tax payroll tax to be imposed beginning January 2021. Retrieved on April 8 2022 1147 AM. And amending Sections 530010 530060 555010 555040 555060 555150 555165 555220 555230 and 6208020 of the Seattle Municipal Code.

This afternoon King County Superior Court Judge Mary Roberts ruled in favor of the City of Seattle upholding as constitutionally permissible the citys payroll tax enacted last summer and dismissing a lawsuit challenging it. The Seattle payroll tax which took effect Jan. Many persons will apply two different rates in calculating the amount of tax due distinguished by payroll expense related to employees making.

Adding a new Chapter 538 to the Seattle Municipal Code. Attachment 1 to this ordinance establishes the proposed spending plan for the 9 first five years of the tax on corporate payroll. The final rules generally adhere to the draft rules except that they remove a provision stating that an employees home is not a business location of the taxpayer Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021.

Taxpayers who calculate payroll expense under subsection 538025B may exclude from the measure of the tax the payroll expense of employees who work within Seattle less than 40 hours during the tax year. The rules clarify several areas of uncertainty in how the ordinance will be implemented. Between 150000 per year and.

4 Companies with annual payroll of at least 7 million 07 tax on the payroll of employees with annual compensation between 150000 - 399999. AN ORDINANCE relating to taxation. Effective January of 2021 the City of Seattle will impose a payroll expense tax on businesses operating in Seattle.

The tax will be imposed on businesses and organizations with at least 7 million of Seattle annual payroll expense Filing Frequency The 2021 payroll expense tax annual return and payment will be due January 31 2022. Body WHEREAS on July 6 2020 the City Council passed Ordinance 126108 imposing a progressive tax on businesses with payrolls of 7 million and higher annually Payroll Expense. The Seattle City Council passed a bill creating a new payroll tax on persons engaged in business in Seattle.

The intent is to use the proceeds from the payroll tax authorized by the ordinance introduced as Council Bill 119810 as follows. Businesses pay the tax for each employee who makes 150000 a year or. And providing additional guidelines for expending proceeds.

This tax applies to businesses when their annual Seattle payroll expense exceeds 7 million. Seattle Payroll Tax. 1 applies to businesses with annual payroll costs of at least 7 million.

Update and Frequently Asked Questions. The applicable tax rate is on a sliding scale from 07 to 24 depending on the persons annual Seattle payroll expense and the level of compensation of the companys employees. 1 exacts a 07 tax on payroll 150000 and over for businesses with annual payrolls of 7 million or.

We previously issued a blast on this ordinance with details on how this tax applies to businesses. The legal challenge to the tax ordinance brought by the Seattle Metropolitan Chamber of Commerce argued that. Imposing a payroll expense tax on persons engaging in business in Seattle.

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Amazon Payroll Subject To New Seattle Tax And Jeff Bezos Is Wealthier Than Ever Washington Business Journal

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Seattle Payroll Expense Tax New Rule And Guidance Issued Berntson Porter Company Pllc

Breakdown Seattle City Council S Head Tax Amendments Seattle Business Magazine

First Results For Seattle S Tax On Its Largest Employers Are In With Stronger Than Expected Revenue For Housing Small Business And The Environment Chs Capitol Hill Seattle

Why The Challenge To Seattle S Payroll Tax Will Fail And Should Fail Post Alley

Seattle Payroll Expense Excise Tax Details

Seattle Payroll Expense Excise Tax Details

Council Discusses Details Of Proposed Payroll Tax

Mandatory Municipal Commuter Benefit Ordinances Tri Ad

First Results For Seattle S Tax On Its Largest Employers Are In With Stronger Than Expected Revenue For Housing Small Business And The Environment Chs Capitol Hill Seattle

Seattle S Payroll Expense Tax On Salaries Of Top Earners Bader Martin

Council Discusses Details Of Proposed Payroll Tax

Seattle S Payroll Tax Complicates Efforts To Implement One Statewide

/cdn.vox-cdn.com/uploads/chorus_asset/file/9776457/shutterstock_623540414.jpg)

Revised Business Tax To Address Homelessness Heads To City Council Curbed Seattle

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire